Want to start earning free or discounted travel? The Chase Ultimate Rewards program includes seven credit cards that largely focus on business and travel rewards to earn free hotel stays, airfare, and more. Here’s how to get started earning Chase Ultimate Rewards points and which credit cards will work best to reward you for your spending habits.

What Are Chase Ultimate Rewards Points?

Ultimate Rewards is the Chase rewards program that allows you to earn Chase Ultimate Rewards points with seven participating Chase credit cards. The program emphasizes rewards for travel and business. Earned points can be redeemed for credit card statement credits, used to book travel through the Chase Ultimate Rewards travel portal, or transferred to a range of hotel and airline partners.

Why Are Ultimate Rewards Points So Valuable?

So, what makes the Chase Ultimate Rewards program one of the best in the industry? Ultimate Rewards points are so prized for their flexibility and how easy it can be to earn Chase Ultimate Rewards points.

These are the two most important characteristics you want when choosing a rewards program.

Easy to Earn

Chase has a good lineup of Ultimate Rewards credit cards that make it easy to earn Chase Ultimate Rewards points on your spending. You’ll earn Ultimate Rewards points on every purchase with a participating Chase card and up to 5x points on bonus category spending. The program includes a good mix of personal and business cards with the ability to earn and combine points across multiple Chase cards. With a welcome offer, you can already start off with up to 100,000 points with an impressive value of $1,250 or more in travel.

Flexible Redemption Options

It isn’t enough for rewards points to be easy to earn; they also have to be easy to use for the things you want. The Ultimate Rewards points you earn can be used in many ways to fit your needs.

Your rewards points won’t expire and you can use them any time you want with no minimum or maximum redemption amounts. Some rewards programs, for example, only let you redeem points starting at a certain threshold.

If you have more than one Chase Ultimate Rewards credit card, you can transfer your rewards between accounts — and even between personal and business Chase cards.

The most standard way of using Chase Ultimate Rewards points is redeeming for statement credits or gift cards.

For an even better value, you’ll want to use your points for travel.

You can book travel with points or a combination of points and cash through the Chase Ultimate Rewards Travel portal — and even earn more points on any cash portion of your booking if you don’t pay completely with points.

You can also transfer points to travel partners which includes a robust lineup of hotel loyalty programs and frequent flier programs.

What Are Ultimate Rewards Points Worth?

How much Ultimate Rewards points are worth depends on which Chase credit card you have.

With a no-annual-fee Chase Ultimate Rewards card, points are worth a standard 1 cent each because they can’t be transferred to airline partners. With other Chase credit cards, Ultimate Rewards points are worth about 2 cents each because they are worth more than standard when redeemed through the Chase Ultimate Rewards Travel portal.

With an annual fee card, you can also transfer points to partner airlines and hotel programs to potentially get an even better value of up to 4 cents per point.

How to Earn Chase Ultimate Rewards Points

You can earn Chase rewards points with any Chase personal or business card that participates in the Ultimate Rewards program. There are seven participating cards: four personal cards and three business cards.

Note: You need a premium Chase Ultimate Rewards credit card with an annual fee to transfer Ultimate Rewards points to travel partners or redeem them through the Chase Ultimate Rewards travel portal for a better rate. If you have a no-annual-fee Chase card that earns Ultimate Rewards, you can still transfer your points to a premium Ultimate Rewards card and pool points across all of your Chase cards. This same strategy allows you to easily turn the cash back you earn with a Chase Ink Business card into Ultimate Rewards points.

Ultimate Rewards Points Earning Personal Credit Cards

You can earn Chase Ultimate Rewards points with four different personal credit cards: two have an annual fee and two don’t.

Here’s a rundown of all four Chase Ultimate Rewards personal cards and their bonus categories.

Earning points with the Chase Freedom Flex

- Current Bonus: The Chase Freedom Flex offers $200 after spending $500 in the first 3 months.

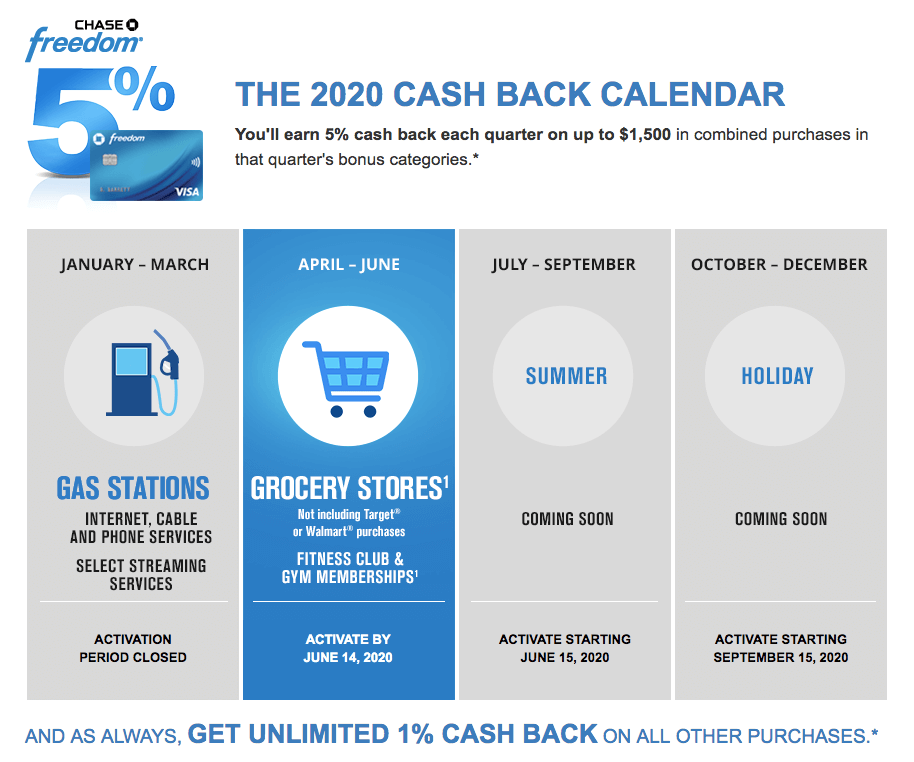

- Benefits: This card earns 5% cash back per dollar in rotating categories (up to $1,500 in purchases per quarter, then 1% cash back after that) and 1% cash back on all other purchases. Maxing out the card’s 5x rotating categories is one of the best ways to boost your Chase Ultimate Rewards points earnings.

- Annual Fee: $0

- Learn More →

The Chase Freedom Flex is a solid no-annual-fee credit card that rewards you for common expenses. The bonus categories rotate every quarter and you need to remember to sign up for them, however. The bonus categories include gas stations, tolls, drugstores, grocery stores, home improvement stores, streaming services, department stores, and purchases using Chase Pay or Paypal.

Earning points with the Chase Freedom Unlimited

- Current Bonus: The Chase Freedom Unlimited offers $200 after spending $500 in the first 3 months.

- Benefits: This card earns 1.5% cash back on every purchase you make. The best part about this is that your cash back will actually tracked as Ultimate Rewards points, which means you earn 1.5x Ultimate Rewards points on every dollar spent. This makes the Chase Freedom Unlimited an excellent credit card for your daily spending.

- Annual Fee: $0

- Learn More →

The Chase Freedom Unlimited is a straightforward cash back card that earns a flat cash back on all purchases without worrying about signing up for or tracking bonus categories that change every few months. You can convert the cash back to Ultimate Rewards points by transferring your rewards to a Chase Ultimate Rewards card with an annual fee like the Chase Sapphire Preferred.

Earning points with the Chase Sapphire Preferred

- Current Bonus: The Chase Sapphire Preferred offers 100,000 points after spending $4,000 in the first 3 months..

- Benefits: This card earns 2x points on all travel and dining purchases and 1x on all other purchases. It has no foreign transaction fees. You also get an array of travel perks including trip interruption/cancellation insurance, delayed baggage insurance and primary car rental insurance. The perks on this card and low annual fee make it our favorite starter travel card.

- Annual Fee: $95

- Learn More →

The Chase Sapphire Preferred is a popular choice for beginners to Chase Ultimate Rewards. This travel rewards card offers a decent rewards rate on travel and dining. Because it is a premium Chase Ultimate Rewards card with an annual fee, you can transfer your points to travel partners or redeem points through the Chase travel portal.

Earning points with the Chase Sapphire Reserve

- Current Bonus: The Chase Sapphire Reserve offers 60,000 points after spending $4,000 in the first 3 months.

- Benefits: With this card you'll get amazing travel benefits such as a $300 annual travel credit, airport lounge access with Priority Pass Select membership, and a $100 Global Entry/TSA PreCheck fee credit. This card also earns 3x points on restaurants and travel (after using your annual $300 travel credit) and 1x points on everything else. Not to mention that you can transfer your earned Ultimate Rewards points at a 1:1 ratio to valuable airline and hotel partners.

- Annual Fee: $550

- Learn More →

While the Chase Sapphire Reserve has a high annual fee, you can more than make up for it if you travel frequently enjoying all the travel benefits you get with this card.

Ultimate Rewards Points Earning Business Credit Cards

If you’re self-employed or have your own business, a Chase business credit card can be a great way to get rewarded for business spending and earn Chase Ultimate Rewards points.

There are three Chase business cards that earn Ultimate Rewards points, although two are actually cash back cards that require you to transfer your rewards to another Chase Ultimate Rewards card like the Ink Business Preferred Credit Card or a personal Chase Ultimate Rewards card.

Earning points with the Ink Business Preferred Credit Card

- Current Bonus: The Ink Business Preferred Credit Card offers 100,000 points after spending $15,000 in the first 3 months.

- Benefits: This card earns 3x points on travel, shipping, internet, phone, cable, and advertising on social media (on up to $150,000 spent per year) and 1x points on everything else. The 3X points earning in the bonus categories are a powerful way to earn lots of valuable Chase Ultimate Rewards points. When you redeem your points for travel through the Chase Ultimate Rewards travel portal you’ll get 25% more value.

- Annual Fee: $95

- Learn More →

Earning points with the Ink Business Cash Credit Card

- Current Bonus: The Ink Business Cash Credit Card offers $750 cash back after spending $7,500 in the first 3 months.

- Benefits: This card earns 5x points on office supplies and internet/cable/phone services (on up to $25,000 spent per year), 2x points on gas and restaurants (on up to $25,000 spent per year), and 1x points on all other purchases. With its 5x earning categories the Ink Business Cash Credit Card is the highest Ultimate Rewards points earning Chase card.

- Annual Fee: $0

- Learn More →

Earning points with the Ink Business Unlimited Credit Card

- Current Bonus: The Ink Business Unlimited Credit Card offers $750 cash back after spending $7,500 in the first 3 months.

- Benefits: This card earns 1.5x points back on every purchase which can be an excellent way to leverage your points earning when paired with another premium Chase Ultimate Rewards earning credit card. It’s one of the best options for non-bonus category spending.

- Annual Fee: $0

- Learn More →

Because these cards have little overlap in their bonus categories, you can actually benefit by having all three Chase Ink Business cards to maximize the points you earn on business spending.

The Ink Business Cash Credit Card is great for restaurants, gasoline, internet and cable service, and office supplies, while the Ink Business Preferred Credit Card is best for cell phone service, digital ads, shipping, and travel. You can use the Ink Business Unlimited Credit Card for everything else you won’t earn bonus points on.

Earn a Welcome Bonus

One of the best ways to earn Ultimate Rewards points in a hurry is with a Chase welcome offer. A Chase Ultimate Rewards sign up bonus can start you off with up to 100,000 bonus points that are worth at least $1,250 in travel or even more when transferred to a partner loyalty program and used strategically.

Chase welcome offers change frequently and typically require meeting a spending threshold within the first 3 months after account opening. In most cases, premium cards like the Chase Sapphire Reserve typically offer higher welcome offers than no-annual-fee Ultimate Rewards cards. However, the welcome offer for the Chase Sapphire Preferred is sometimes even higher.

Spending on Credit Cards

The primary means of earning Chase Ultimate Rewards points is by using a Chase Ultimate Rewards credit card. With any Chase card that participates in the program, all spendings will earn Ultimate Rewards points, including gas, utilities, online rent payments, and concert tickets.

With most purchases, you’ll earn 1x Ultimate Rewards point per $1 with the ability to earn up to 5x points on bonus categories. Two Chase cards instead earn an unlimited 1.5x points on all purchases with no bonus categories.

Earn Extra Points with Bonus Spending Categories

The best way to earn lots of Chase credit card points is with bonus categories that let you earn up to 5x Ultimate Rewards points per $1. Most Chase Ultimate Rewards credit cards offer bonus categories, although two cards earn just a flat 1.5x points that make them better suited for everyday purchases.

Here’s how to earn Chase Ultimate Rewards points with bonus category spending.

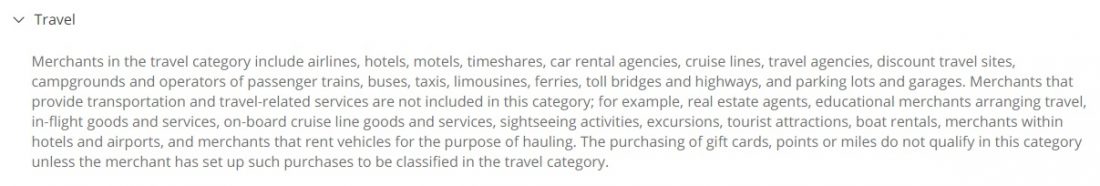

Travel

Chase has a very broad definition of what’s considered “travel” and this is one of the most valuable bonus categories because you’ll likely do a lot of travel spending every year. All three Chase Ultimate Rewards cards with an annual fee earn bonus points on travel.

- Chase Sapphire Reserve

- 3x Ultimate Rewards points on travel (after the first $300 in travel spending per year)

- Chase Sapphire Preferred

- 2x Ultimate Rewards points on travel

- Ink Business Preferred Credit Card

- 3x Ultimate Rewards points on travel (on up to $150,000 in spending per year combined with other bonus category spending)

- Sometimes certain travel expenses like tolls can earn 5% back (5x Ultimate Rewards points) with the Chase Freedom Flex rotating bonus categories.

Note Chase’s broad travel category:

Gas stations

Gasoline is probably one of your biggest monthly expenses after housing and food. The average houshold spends nearly $2,000 per year on gasoline alone. Take the sting out of filling up and earn Chase points on gasoline with these cards.

- Ink Business Cash Credit Card

- 2% cash back (2x Ultimate Rewards points) on the first $25,000 in combined gasoline and restaurant spending per year

- Ink Business Unlimited Credit Card

- 1.5% cash back (1.5x Ultimate Rewards points) on all purchases

- Chase Freedom Unlimited

- 1.5% cash back (1.5x Ultimate Rewards points) on all purchases

- Chase Freedom Flex often includes gasoline as a bonus category too, where gasoline is a bonus category for two out of four quarters with 5% cash back or 5x Ultimate Rewards points at gas stations.

Supermarkets

Surprisingly, Chase doesn’t offer a card that lets you earn bonus Chase Ultimate Rewards points for grocery store spending, even though this is one of the largest spending categories for most people. The best way to earn points in the Chase Ultimate Rewards program on groceries is by using one of the cards with an unlimited 1.5% back.

- Ink Business Unlimited Credit Card

- 1.5% cash back (1.5x Ultimate Rewards points) on all purchases

- Chase Freedom Unlimited

- 1.5% cash back (1.5x Ultimate Rewards points) on all purchases

- You can also watch for a supermarket bonus category with the Chase Freedom Flex to potentially earn 5% back (5x Ultimate Rewards points) at grocery stores.

Dining and Eating Out

There are three Chase Ultimate Rewards cards that earn bonus points for restaurant spending.

Note: this includes eat-in or sit-down dining as well as fast food and many lounges and bars that sell food.

- Chase Sapphire Reserve

- 3x Ultimate Rewards points on dining

- Chase Sapphire Preferred

- 2x Ultimate Rewards points on dining

- Ink Business Cash Credit Card

- 2% cash back (2x Ultimate Rewards points) on the first $25,000 per year in combined gas station and restaurant spending per year

Office Supplies

If you spend a lot on office supplies for your business, you can earn rewards fast with one of the Chase Ink Business cards. To qualify for the bonus with the Ink Business Cash Credit Card, you need to shop at a store that specializes in office supplies like Staples or Office Depot, not Walmart, for example.

- Ink Business Cash Credit Card

- 5% cash back (5x Ultimate Rewards points) at office supply stores (on up to $25,000 per year in combined spending in bonus categories)

- Ink Business Unlimited Credit Card

- 1.5% cash back (1.5x Ultimate Rewards points) on all purchases

Business Spending

Office supplies aren’t the only business purchases you’re likely to make. If you travel for business, advertise online, or incur shipping, cable, and internet costs, the best Chase card to use is the Ink Business Preferred Credit Card.

The Ink Business Preferred Credit Card earns 3x Ultimate Rewards points on the first $150,000 combined per year for these common business purchases:

- Phone services

- Internet services

- Cable services

- Shipping costs

- Travel expenses

- Digital advertising on search engines and social media

The Ink Business Cash Credit Card is another good option and earns 5% cash back (which can be turned into 5x points when transferred to another Chase Ultimate Rewards card) on the first $25,000 combined per year for these expenses:

- Internet services

- Phone services

- Cable services

- Office supply stores

Note that wireless data charges, satellite TV, and satellite radio also count toward bonus spending, but purchasing equipment like a cell phone won’t.

Mobile Phone Bills

Only two of the Chase business cards specifically offer bonus points for cell phone expenses.

- Ink Business Preferred Credit Card

- 3x Ultimate Rewards points on cell phone service (on up to $150,000 per year combined across other bonus categories)

- Ink Business Cash Credit Card

- 5% cash back (5x Ultimate Rewards points) on cell phone service (on up to $25,000 per year combined across other bonus categories)

None of the Chase Ultimate Rewards personal credit cards offer cell phone service as a bonus category. However, the Chase Freedom Unlimited is the best option for paying for cell service with a flat and unlimited 1.5% back (1.5x Ultimate Rewards points).

Everyday Spending

For all spendings outside of bonus categories, your best bet for earning Chase Ultimate Rewards points is either the Chase Freedom Unlimited or the Ink Business Unlimited Credit Card.

Both cards earn a flat and unlimited 1.5% cash back (or 1.5x Ultimate Rewards points).

Earn Points with Chase Offers

Chase Offers is a program that offers targeted offers to Chase cardholders through the Chase Mobile app. These offers give you statement credits or bonus points when the offers are activated and you meet the guidelines, such as shopping with a specific retailer.

All Chase Offers deals are targeted depending on which Chase card you have, where you shop, and how often you use each card. Chase Offers deals can be stacked with the Ultimate Rewards points you earn with your Chase Ultimate Rewards credit card.

Booking Travel Through Ultimate Rewards Travel

With an annual fee Chase Ultimate Rewards credit card, you can redeem points through the Ultimate Rewards Travel portal to get an even better value for your points. You may not know that you can also earn Chase points by purchasing travel through the portal.

If you pay for part of your travel with Ultimate Rewards points and the rest with your Chase Ultimate Rewards card, you’ll earn Ultimate Rewards points for the amount charged to your card.

Shop Through Chase Ultimate Rewards Shopping Portal

With the Chase credit card shopping portal, you can earn Chase Ultimate Rewards points for everyday spending at partner retailers. Once you log into the Ultimate Rewards shopping portal with your Chase login, you can select a Chase credit card to use and earn up to 20x points. With most retailers, you’ll earn 2x to 5x bonus Chase points.

You must click on the retailer and choose the “Shop Now” button to get redirected to the retailer’s website and earn points.

Note: The bonus points you earn through the Chase shopping portal can be stacked with the points you earn for using a Chase Ultimate Rewards credit card and any offers through Chase Offers.

For example, you can use the Chase Freedom Unlimited and shop at Dick’s Sporting Goods through the Ultimate Rewards shopping portal after activating a targeted Chase Offer for Dick’s. You can get the cash back from the Chase Offer plus 1.5x Ultimate Rewards points with the Chase Freedom Unlimited and bonus points for shopping through the portal.

Refer a Friend

Did you know you can earn credit card points without spending money? With the Chase Refer-a-Friend program, you can earn up to 20,000 Ultimate Rewards points every time you refer a friend to a Chase Ultimate Rewards credit card and up to 100,000 bonus referral points per year.

Your friend needs to sign up for the same card you have and your card must participate in the program. The following Chase Ultimate Rewards credit cards can earn referral bonuses:

- Chase Sapphire Preferred – 15,000 Ultimate Rewards points per referral

- Chase Freedom Flex – $50 cash back (5,000 Ultimate Rewards points) per referral

- Chase Freedom Unlimited – $100 cash back (10,000 Ultimate Rewards points) per referral

- Ink Business Unlimited Credit Card – $150 cash back (15,000 Ultimate Rewards points) per referral

- Ink Business Preferred Credit Card – 20,000 Ultimate Rewards points per referral

Learn more about the Chase Refer-a-Friend program here.

Add Authorized Users

When you add an authorized user to your Chase Ultimate Rewards credit card, you’ll earn Ultimate Rewards points on all of their spending, including bonus points for spending in bonus categories.

You may also receive a bonus offer when you add a new authorized user to your card. For example, the Chase Sapphire Preferred sometimes offers a bonus when you add authorized users who make a purchase within 3 months.

Note: There may be a fee to add authorized users. With the Chase Sapphire Reserve, there’s a $75 fee for adding authorized users, although they will receive their own Priority Pass Select membership.

Wrap Up

The Chase Ultimate Rewards program has a well-earned reputation as one of the best credit card reward programs. It offers everything you should be looking for in a program with rewards points that are easy to earn, valuable, and flexible.

Whether you want simple statement credits or, more likely, you want to get rewarded for your daily spendings or travel and earn free airfare, hotels, and more. It’s easy to get started with Chase Ultimate Rewards with the right Chase credit card that fits your spending.

FAQs

What are Chase Ultimate Rewards points?

Which Chase credit cards earn Ultimate Rewards points?

Chase Sapphire Preferred,

Chase Sapphire Reserve,

Ink Business Preferred Credit Card,

Ink Business Cash Credit Card,

Ink Business Unlimited Credit Card